Business Expenses

In This Article

Parachute helps manage and track your business expenses. Simply login to Parachute, and enter all expenses as shown below. Once expenses are entered, you will have access to several reports to review and help prepare your taxes each year.

View & Search Business Expenses

-

From the menu to the left click Accounting, then click on Expenses.

-

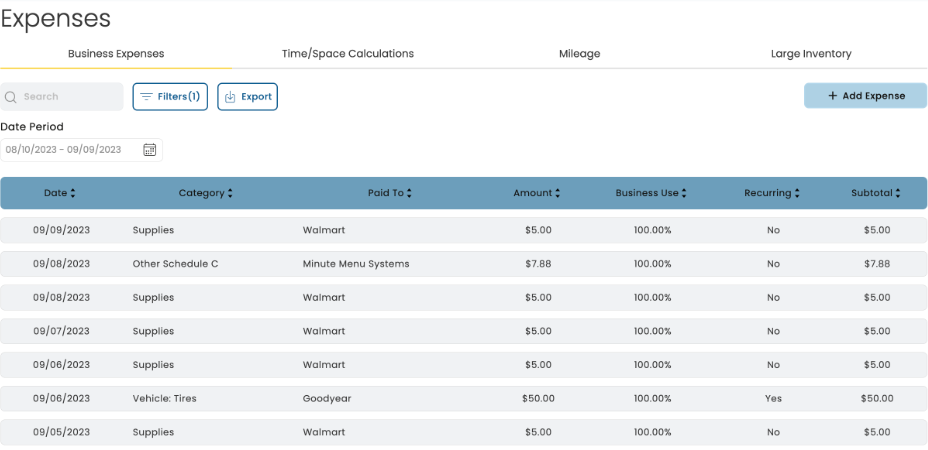

The Expenses page opens.

-

To search for expenses that have already been entered, use the search bar or filters.

-

Search: Start entering in any data found on the invoice(s) you're looking for to automatically filter the search results.

-

Filters

-

Date or Date Range: When the income was received

-

Category: Select the expense category for the expense line item you're looking for. This list will include custom categories that have been added.

-

Amount: The amount of the expense line item.

-

Subtotal: This will filter expenses based off of subtotal when Business Expense % is applied.

-

Business Use: This will filter expenses based on the business use entered in the expense.

-

Recurring: This will filter based on if the expense is recurring or not.

-

-

Export: Export data to an Excel or CSV File. Only the data currently being populated based on the selected filters and columns will be exported.

-

Add Business Expenses

To add new expenses:

-

From the menu to the left click Accounting, then Expenses.

-

From the Business Expenses tab, click

in the top right corner.

in the top right corner. -

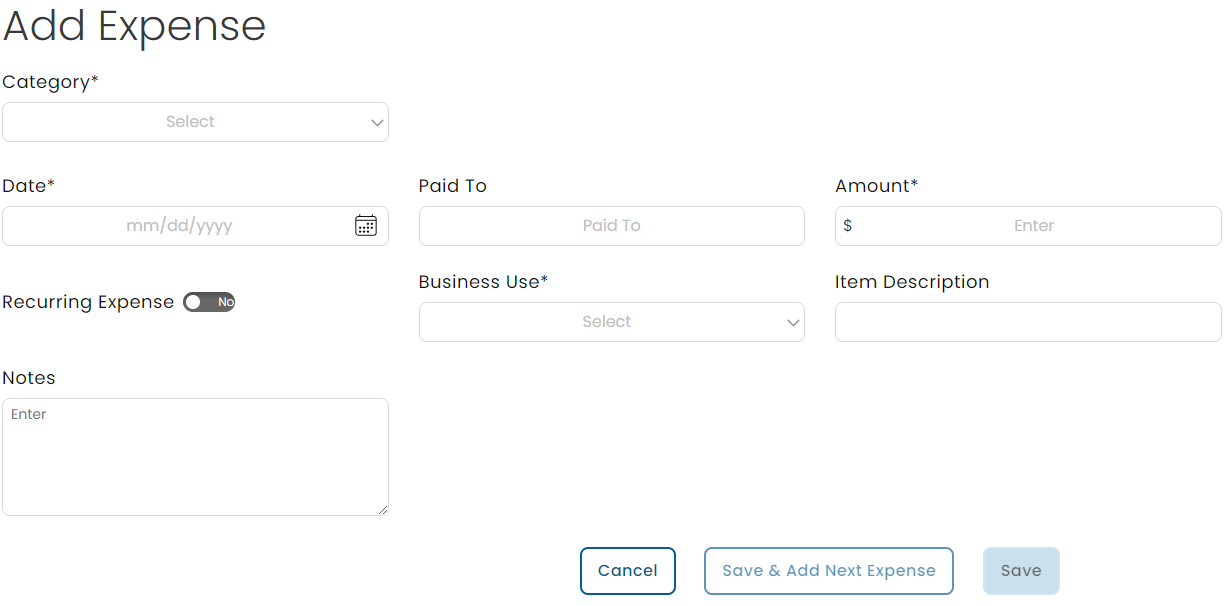

The Add Expense page opens.

-

Fill out the required fields for the expense being entered.

-

Category: If one of the standard categories does match your expense you can add a custom category. To do this, scroll to the bottom of the list and click

. After adding a custom expense type you can click the

. After adding a custom expense type you can click the  button to edit it or

button to edit it or  to delete it from this list.

to delete it from this list.Note: If you delete a custom expense type in the Category list it will not delete or make any changes to expenses related to that custom field

-

Date: The date the expense was charged

-

Paid To: The source of the expense

-

Amount: The total amount of the expense

-

Business Use:

-

100% Business Use

-

Actual Business Use: This allows you to manually enter what % of this expense is for your business

-

Time/Space%: This will use your Time/Space calculation to determine how much of this expense should be considered business use

-

-

Vehicle

-

Recurring: Select how frequently this Expense should show up as a new line item

-

-

Once all fields are completely filled out, click

to return to the Business Expenses page, or click Save & Add Next Expense to start entering another expense.

to return to the Business Expenses page, or click Save & Add Next Expense to start entering another expense.

Edit Business Expenses

To edit a Business Expenses that has already been entered:

-

From the menu to the left click Accounting, then Expenses.

-

From the Business Expenses tab, click on the expense that needs to be edited.

-

Make adjustments to fields as needed.

-

Click Save.

Additional articles can be found on entering Time/Space Calculations, Mileage, and Large Inventory for your home or center business.